Tenor can manage your e-invoices in accordance with the reform of mandatory e-invoicing in France thanks to its future Partner Dematerialization Platform.

The reform on e-invoicing planned by the DGFiP will make the dematerialization of invoices mandatory from 2024. Resulting from the Finance Law of 2020, it provides for the mandatory generalization of e-invoices and the transmission of data to the tax authorities. This concerns all transactions between VAT payers in France. Dematerialization Platforms Partners and Dematerialization Operators will be able to play the role of intermediaries between companies and the Public Billing Portal of the State.

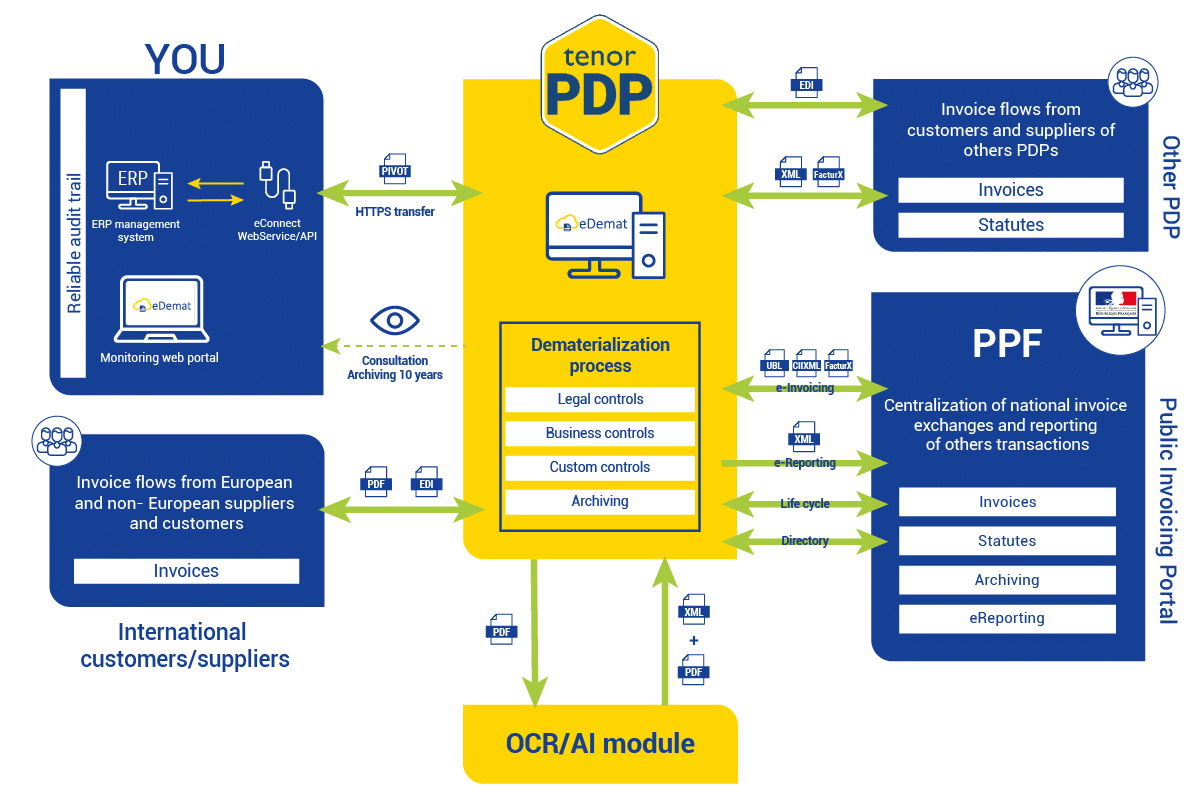

In order to continue to provide the best possible support to its clients, Tenor has initiated the work required to become a PDP (Platform for Dematerialization Partner). A PDP is an e-invoicing platform that is compatible with the requirements of the reform and is certified by the French government for a renewable period of three years. Thanks to this registration procedure by the government, Tenor will be identified as a trusted third party. This official registration, validated by an audit, will enable our eDemat e-invoicing solution to manage invoices and transmit them to the PPF or a third-party PDP. Tenor is thus positioned as a certified private intermediary between companies and the State.

The operation is very simple. You just have to connect your ERP or your accounting management tool to the eDemat platform.

The latter recovers your entire invoice flow and dematerializes it physically while respecting legal constraints. It relies on the centralized directory of the State to know the distribution PDP chosen by your customer. eDemat then distributes your invoice in the selected format and archives it in an electronic safe with probative value. Your customer, as well as yourself, will be able to access the invoice archive for 10 years, which is the legal archiving period.

The eDemat platform allows you to have all of your dematerialized invoices accessible in one place.

ISO 27001 is an international standard for information security.

It establishes requirements for the implementation and management of an Information Security Management System (ISMS), focusing on risk assessment and the implementation of measures to safeguard the confidentiality, integrity and availability of information.

This certification testifies to our commitment to adopting an effective approach to implementing appropriate controls, thereby guaranteeing the security of our customers’ sensitive data.

Tenor’s teams specializing in e-invoicing regularly attend FNFE (Forum National de la Facture Electronique) and DGFiP/AIFE meetings in order to keep abreast of the legislator’s expectations. In fact, our eDemat solution is already operational for Factur-X and the semantic formats adopted by the DGFiP, for issuing customer invoices as well as for receiving supplier invoices. It is also already connected to Chorus Pro.

Non-compliance with the obligation to invoice electronically

A fine of €15 per invoice, up to a maximum of €15,000 per year.

Non-compliance with the e-reporting obligation

A fine of 250 € per invoice, up to 15 000 € per year.

Many chartered accountants point out that all irregularities and breaches in invoicing, obligatory mentions or payment deadlines become more visible and detectable with the transmission and processing of invoices by electronic means.

A Dematerialization Operator is a service provider whose functions are the preparation of e-invoices, the control of mandatory mentions, business controls and the formatting of the invoice in a compliant electronic format.

The DOs are not referenced by the tax authorities. Therefore, they cannot send/receive invoices or transmit invoicing data directly to a third party. They will have to go through the PPF or a PDP. Therefore, depending on your needs, it will be more appropriate to work directly with a PDP.

Need a partner for your e-invoicing ?

Let’s talk about it !

Our experts regularly publish articles on EDI, EAI and e-invoicing in the blog section of the site.

Go further with our resources and expertise !