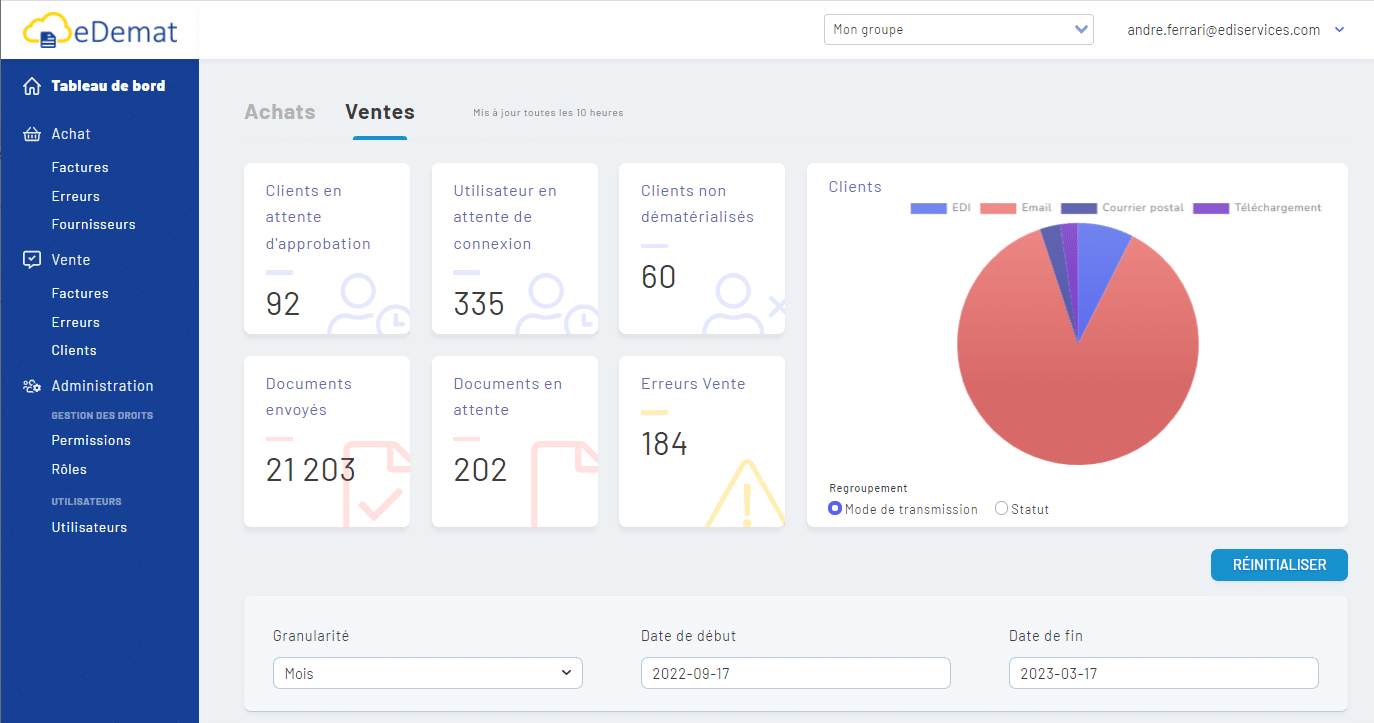

eDemat is Tenor’s tax-compliant dematerialization platform that enables you to manage your e-invoices with ease. Developed by Tenor, the tool has been dematerializing the sending and archiving of invoices for several hundred companies since 2009 and has continued to evolve over the years.

eDemat supports you in all your e-invoicing needs : dematerialization of incoming and outgoing invoices in the desired formats, EDI invoices, customized portals to manage your exchanges with your business partners, etc.

Switch to e-invoicing now for your customer and supplier invoices quickly and easily with Tenor! Create, send and archive your e-invoices with eDemat in compliance with legal obligations, with complete peace of mind.

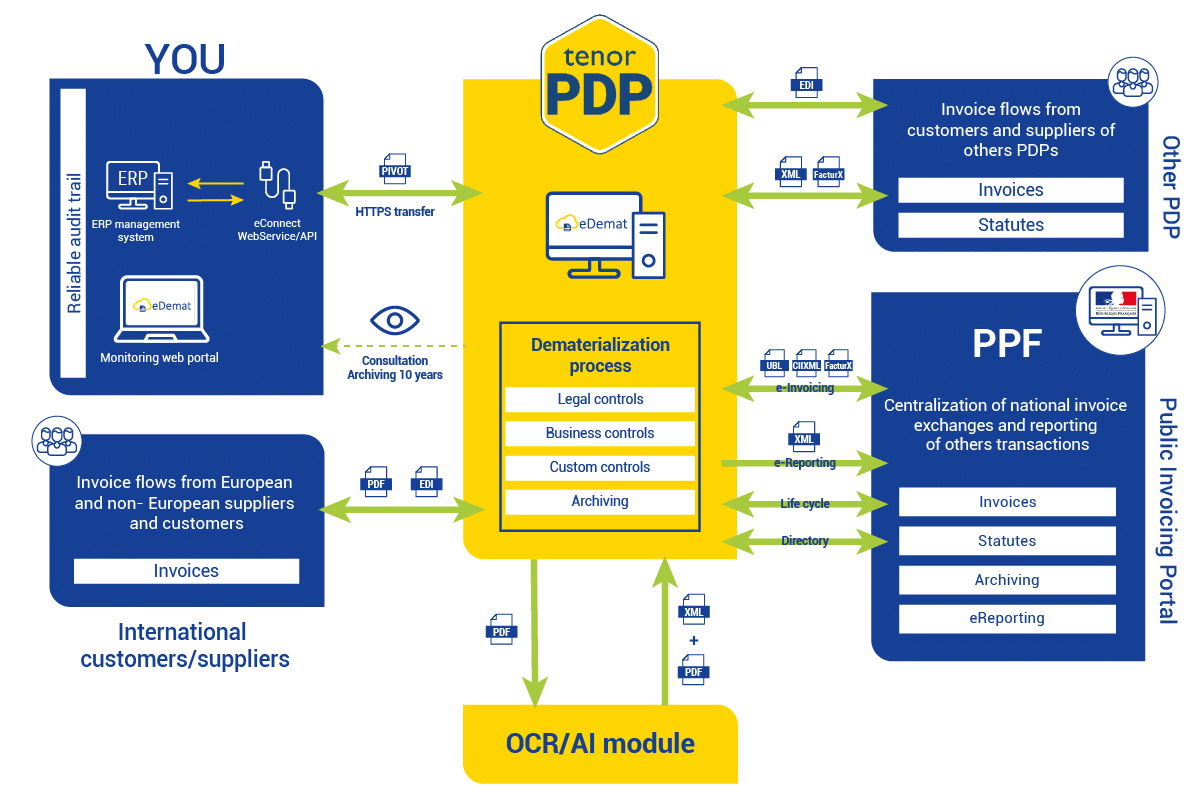

Article 26 of the amended finance law for 2022 will make it compulsory, from 2024, to generalize electronic invoicing and the transmission of invoicing data to the tax authorities. To meet the obligations of the reform, companies will have to issue electronic invoices and send them through the PPF, the Public Billing Portal. To do this, they can either transmit them themselves (with the potential help of a dematerialization operator) or go through a PDP, Platform of Dematerialization Partner.

Tenor has initiated the work that will enable it to become a PDP, Partner Dematerialization Platform, in order to best meet the specific and evolving needs of its customers.

ISO 27001 is an international standard for information security.

It establishes requirements for the implementation and management of an Information Security Management System (ISMS), focusing on risk assessment and the implementation of measures to safeguard the confidentiality, integrity and availability of information.

This certification testifies to our commitment to adopting an effective approach to implementing appropriate controls, thereby guaranteeing the security of our customers’ sensitive data.

The Tenor team has developed a simple yet comprehensive solution that works with the majority of ERPs available on the market.

Connectors are already in place with the following ERP systems: Elo, Oracle, PMI, XRP SPRINT, XRP FLEX, SAP (R/3, S/4), SAP Business One, StraDivalto, IFS, Proginov, SAGE 100, X3, Obilog and SilverCS.

We can help you with any specific integration.

Need a partner for your electronic invoicing ?

Let’s talk about it !

Our experts regularly publish articles on EDI, EAI and e-invoicing in the blog section of the site.

Go further with our resources and expertise!