BREXIT, what impact on EDI and invoicing ?

21 June 2023

21 June 2023

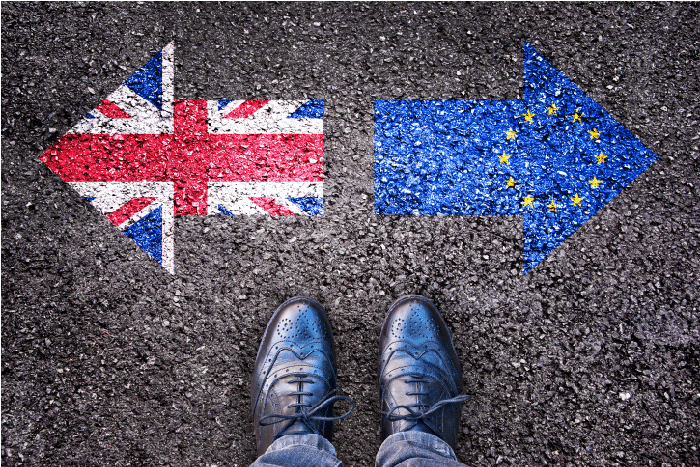

The BREXIT negotiations are over, with a provisional agreement between the EU and the UK coming into effect on January 1, 2021.

To keep trade flowing smoothly between the UK and the EU, Customs has instituted a Smart Border.

Border. This involves the deployment of the “SI BREXIT” Information System for processing customs declarations and logistics envelopes.

To ensure that their goods cross the Intelligent Border, companies need to organize upstream.

What steps must they take to comply with this new organization ?

With the UK now outside the EU, companies that have not yet traded outside the EU need to update their Commercial Management data with new codifications, EORI numbers and HS codes.

Companies exporting or importing outside the EU are required to have an EORI (Economic Operators Registration and Identification) number.

mandatory.

The EORI is assigned at establishment level, and its format is FR+SIRET.

Application for an EORI number is free of charge and must be made to the customs authorities.

All imported and exported goods must be identified with a HS (Harmonized System) code. HS codes, or commodity classification codes, enable customs services to identify the type of product to determine customs duties, taxation (VAT and various taxes), formalities and regulations to be applied (safety standards, phytosanitary standards). These codes are also used for foreign trade statistics. HS codes are available on the Customs website.

HS codes are also known as commodity codes. These codes enable customs authorities to identify the type of product, and to determine the rate of VAT or customs duty to be applied to the goods. No goods can be exported or imported without these codes.

A commercial invoice or pro-forma invoice is mandatory when shipping goods outside the EU. This document, in triplicate, must physically accompany the goods. It is primarily used by customs to identify goods and calculate customs duties.

For all EDI shipments between the UK and the EU, upgrades to the data exchanged will be required. ASN or DESADV messages, and packing lists will have to support new

new information.

The information transmitted by the messages must reflect the commercial invoices. The following segments must be added or updated :

Many logisticians, large companies, automobile manufacturers and OEMs (Original Equipment Manufacturers) are updating and communicating their new EDI specifications to their partners.

EDI systems and solutions, WEBEDI and paperless invoicing are all advantages for companies exporting to the UK.

Dematerialization will make it possible to anticipate shipments by communicating declaratory documents to customs, carriers and importers as quickly as possible. This will make it possible to cross the Smart Border without stopping, and to meet delivery deadlines.

For over thirty years, Tenor has been helping its customers to manage their EDI and dematerialize their invoices, in particular with e-invoicing software. Our tools are already operational for BREXIT.