What are the benefits of automating the Order-To-Cash cycle ?

15 June 2023

15 June 2023

“Selling”, “Delivering”, “Getting paid” is the daily business of every company. These actions provide the company with the cash resources it needs to pay its suppliers, remunerate its staff, pay dividends to its owners, and invest in its development. The sequence of these actions is known as the Order-To-Cash cycle, from order to collection.

Let’s take a look at how the digital transformation of the Order-To-Cash cycle enables a company to serve its customers better and earn more.

The Order-To-Cash cycle or process includes order processing and upstream and downstream operations. Order-To-Cash or O2C covers all operations from the sales proposal or quotation to receipt of payment by the customer.

Depending on the type of customer: BtoC or BtoB, the nature of the good or service ordered, a simple item to be delivered, an order to be prepared, a good that needs to be put into production, a service to be planned, etc., the operations between the drafting of the purchase order and the receipt of payment will be more or less numerous and different according to the business, but the stages of the O2C cycle remain identical for all.

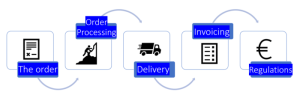

The Order-To-Cash cycle is divided into five stages. At each stage, a succession of actions and controls validate the passage to the next stage. The common thread is the transformation of the customer’s order book into cash.

The O2C cycle begins before the order is signed. The aim is to validate the drafting of the purchase order internally, before sending it to the customer. This ensures that the commitment of both parties, supplier and customer, to deliver and pay, can be respected.

To this end, the purchase order must refer to a price list, a quotation or a sales proposal.

The general sales conditions must be brought to the customer’s attention, and if there are special conditions, these must be validated by the legal department beforehand. If there is a provisional delivery date, this must be validated by the departments concerned: purchasing, production, delivery.

On receipt of the order, checks are carried out on :

From this point on, order preparation operations can begin. This could be a simple shipment of goods, an industrial production start-up, or a schedule of appointments for service providers. With purchases from suppliers and subcontracting orders.

If delivery is to be made by a carrier, transport must be booked in advance of the planned delivery date. Delivery is evidenced by a proof of delivery, such as a signed or stamped delivery note, or a signed acceptance report.

Delivery also marks the start of a warranty period, and after-sales and maintenance departments must be informed.

From July 2024, electronic invoicing or e-invoicing will gradually become compulsory for all BtoB domestic customers. Invoices will be issued on receipt of proof of delivery, via a connection to a Partner Dematerialization Platform (PDP). The company will then be able to monitor the customer’s invoice processing in real time. The customer will update the status of the invoice according to the e-reporting obligation: received, approved, in payment, disputed.

At this final stage of the cycle, it is necessary to reconcile the amounts paid by the customer with the amounts of the invoices due. By attaching a payment to one or more invoices, the amount can be allocated to an order.

Late-paying invoices must be identified, so that reminders can be sent out, and collection initiated if the invoice remains unpaid.

The Order-To-Cash process addresses four key issues in order management :

Automating the Order-To-Cash cycle is a transerve project requiring the implementation of various IT resources and solutions. These means enable information to be centralized, controlled and shared between the company’s various software solutions.

First and foremost, the dematerialization of all commercial and accounting documents.

Purchase orders, delivery notes, letters, invoices, proofs of delivery, etc.

All documents must be stored in an EDM for easy access by all. And linked with company applications: CRM, ERP, accounting.

Workflows can be used to create validation circuits between departments. They enable the fluid circulation of information between the company’s various departments. For example: receipt of an order triggers preparation, delivery triggers invoicing.

The company’s reference data must be managed. This ensures that all the company’s software solutions share the same data. Data quality is of paramount importance when setting up automated processes; otherwise, errors due to erroneous data will prevent automated processes from being optimized.

To automate inter-application exchanges, data integration solutions such as EAI (Enterprise Application Integration) connect business applications (CRM, ERP, Production Management, Accounting). Share the same reference data.

When a portal is set up, it enables exchanges with the customer. Facilitate appointments for deliveries or interventions. Push documents. Similarly, electronic signature solutions secure the signing of contracts and orders.

By starting the Order-To-Cash cycle with the initial purchase order, the risk of errors and non-conformity of the order is reduced. Signed orders are processed more quickly, as the order details have already been validated internally.

The elimination of manual re-entry and validation tasks saves time per order, and increases order processing capacity within shorter lead times. This contributes to a reduction in the time between order taking, delivery and invoicing. This acceleration translates into a reduction in working capital requirements.

The implementation of validation workflows and the dematerialization of documents and their archiving in an EDM guarantee the traceability of operations. The entire history of an order or a customer is immediately accessible.

With the traceability of operations for each order received, delivered and invoiced, and the archiving of purchase order and delivery note documents in an EDM. A reliable audit trail, or PAF, has already been established for every invoice issued.

Automating the order-to-cash cycle frees up more time for customer relations. The quality of the documents sent, and the reduction in lead times between all stages of ordering, delivery and invoicing, all contribute to a better customer experience. It also enhances the company’s image with customers.

Tenor has been an expert in data flow exchanges for over 30 years, supporting you in your EDI, EAI and e-invoicing projects. Contact our experts and launch your project.